Spend Management Through Numbers and Statistics

September 15, 2024

Moola & Samet Expand Expense Management

February 19, 2025Is Your Company’s Spend Management as Efficient as It Can Be? Find Out with Moola!

Did you know that 54% of companies lack real-time visibility into their expenses, only finding out what they’re actually spending AFTER budget issues arise?

This delay can lead to increased fraud risk, inaccurate budgeting, and lengthy monthly financial closings.

(Source: Airbase)

Such delays hinder your ability to make quick, data-driven financial decisions.

We live in a fast-paced business environment, one where relying on traditional Spend Management methods not only inflates costs, but also leads to missed opportunities for improving financial efficiency.

So, the number 1 question here is: How do you effectively manage your company’s expenses and maximize savings every step of the way?

The Problem with Traditional Expense Management

Many companies rely on manual systems and human effort to track expenses. That’s a problem, and here’s why:

- Prone to Error

Manual tracking naturally leaves room for human error, making spend management and expense monitoring a slow and flawed process. - Slow Approvals

Expense approvals are often handled via emails or paper-based systems, potentially delaying your next critical business decisions. - Manual Recording of Invoices

Invoices and receipts are logged manually, creating a breeding ground for financial errors and inefficiencies. - Fragmented Financial Data

Financial data that’s all over the place weakens a company’s understanding of its financial health, making it harder to predict expenses or identify waste. - Resource-heavy Processes

Traditional methods require large teams to process invoices, review expenses, and generate reports. That costs money, a lot of it, and it consumes valuable time as well. - Time-consuming Financial Closings

Monthly closings take too long, delaying insights into financial performance and slowing effective planning down to a crawl in some cases.

The Hidden Costs of Inefficiency

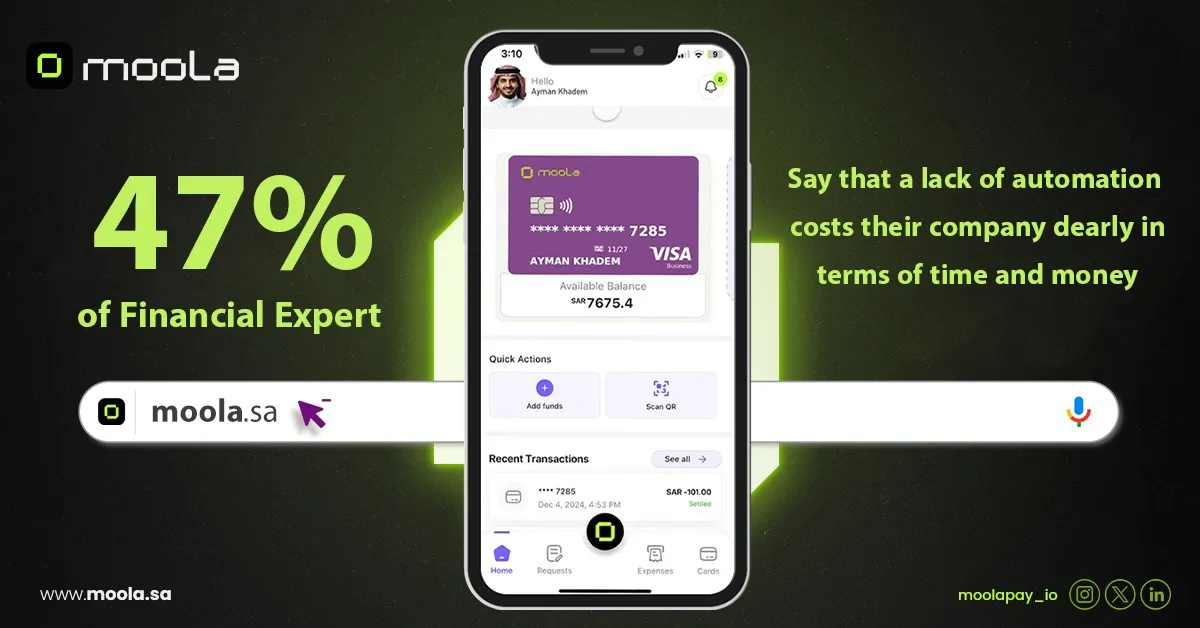

It’s not surprising that 41% of global finance experts report being far less efficient than they could be due to a lack of accounts payable (AP) automation, and 47% say this inefficiency is costing their companies dearly in time and money.

(Source: The Spendlightenment Survey of Finance Professionals by Airbase)

Additionally, employee-related expense fraud often takes 14 months to uncover!

(Source: Association of Certified Fraud Examiners)

These worrying findings highlight the critical need for modernized spend management solutions to help companies reduce losses, improve performance, and stay competitive.

How Leading Companies Overcome Expense Management Challenges

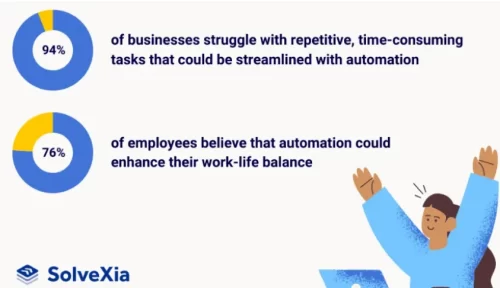

A report by Bill.com shows that 89% of accountants believe automation has reduced errors and made their companies more profitable and efficient.

According to Solvexia, automating financial processes has led to a 90% reduction in accounting errors, and 94% of companies struggle with repetitive tasks that automation can otherwise handle easily.

With Automation in The Picture:

- Finance teams are freed from repetitive tasks, allowing them to focus on the tasks that really matter, like financial planning and opportunity analysis.

- Financial reconciliation processes are completed up to 100 times faster! (Source: Solvexia)

What is the best spend management software for your business?

Moola is an advanced spend management platform designed to enhance financial control and streamline your company’s expense handling.

From keeping track of all expenses and approving them to precise and speedy reconciliation, Moola automates every stage of expense management.

Key features of Moola include:

- Virtual and Physical Cards: Customizable cards for tracking expenses while ensuring adherence to financial policies.

- Real-time Insights: Instant access to expense patterns for smarter decision-making.

- Seamless Integration: Moola integrates effortlessly with existing accounting systems.

Why Moola?

- Centralized Spend Management

Manage all company expenses in one place. - Automated Approvals

Say goodbye to delays. Automated approval systems streamline decision-making and keep your business running smoothly. - Real-time Expense Monitoring

Gain a competitive edge with instant visibility into your expenses, letting you make timely financial decisions with confidence. - Accurate Reporting and Forecasting

Generate intelligent reports to anticipate future expenses and identify areas for cost optimization. - Easy Integration

Connect seamlessly with your existing accounting tools without major infrastructure changes. - Robust Security

Leverage advanced security measures to protect your financial data and minimize risks. - Cost Reduction and Efficiency Improvement

Pinpoint areas of waste and capitalize on analytics to optimize spending and reduce operational costs.

Proven Results with Moola

Using Moola delivers tangible benefits, such as:

- 5% average savings on overall expenses through smarter expense management.

- 4,000 hours saved annually by eliminating tedious manual processes.

- 35% increase in team efficiency thanks to financial process automation.

Secure and User-Friendly

At Moola, data security is a top priority. Our platform incorporates strict protection measures, including data encryption, global compliance standards, and regular security audits.

Additionally, Moola makes team management simple. Add new users with the click of a button, and provide them with a simple onboarding experience via step-by-step guidance and dedicated customer support.

Unlock Your Company’s Financial Potential

No more worrying! With Moola, you can overcome the challenges of traditional expense management, save time and money, and make informed financial decisions using real-time insights.

Ready to Feel the Moola Difference?

Take the first step toward a smarter financial future with Moola! Sign up for a free trial today and Join the leading companies already leveraging Moola to optimize their spend management strategies.